capital gains tax changes 2020

If you sell stocks mutual funds or other capital assets that you held for at least one year any gain from the sale is taxed at either a 0 15 or 20 rate. A year plus a day isnt really a long time for many investors but its the rule that lawmakers arbitrarily selected.

What You Need To Know About Capital Gains Tax

500000 of capital gains on real estate if youre married and filing jointly.

. Rates for long-term capital gains are based on set income thresholds that are adjusted annually for inflation. Capital gains tax CGT is the tax you pay on profits from. Payable within 30 days.

Capital gains tax on account In 2018 the government also proposed that CGT would be payable on account within 30 days of the completion date for all UK residential. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. The higher your income the higher the rate.

The main changes that were made to Capital Gains Tax were regarding the deadlines for paying it after selling a residential property in the UK. Capital Gains Tax changes April 2020 1. Since 6th April 2020 if youre a UK resident and sell a piece of residential property in the UK you now have 30 days to let HMRC know and pay any tax thats owed.

Some or all net capital gain may be taxed at 0 if your taxable. Capital Gain Tax Rates. The Lowdown on Capital Gains Tax Rates for 2020 and Beyond.

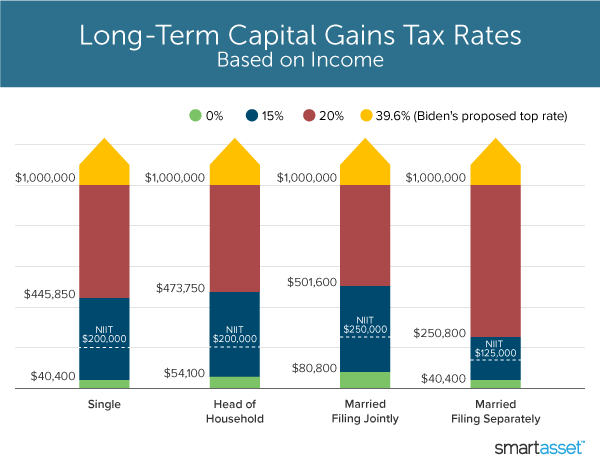

Senate Bill 557 enacted in November 2019 includes several tax changes. The tax rate on most net capital gain is no higher than 15 for most individuals. Long-term capital gains are usually subject to one of three tax rates.

PPR Relief last 9 months. Long-term capital gains taxes are assessed if. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

The standard deduction increased for inflation. Get ready for changes to Capital Gains Tax payment for UK property sales The deadlines for paying Capital Gains Tax after selling a residential property in the UK are. What were the Capital Gains Tax changes.

It was as a rule paid the following year for instance if you sold a property in the 2018-2019. Taxpayers who dont itemize deductions can claim the standard deduction an amount predetermined by the IRS that. Long-term capital gainstaxes are assessed if.

If you bought Bitcoin CRYPTOBTC in 2018 and sold it for a profit. Capital Gains Tax changes April 2020 1. Ready or not tax return reporting has changed yet again for the 2020 tax season.

In the past you paid your Capital Gains Tax when you completed your Self-Assessment tax return. In 2018 the IRS significantly reduced the. In 2018 the IRS condensed Form 1040 significantly completely revamping the prior traditional.

First deduct the Capital Gains tax-free allowance from your taxable gain. Add this to your taxable income. Previously it was not necessary to report or pay CGT until you submitted your.

Since the 2021 tax brackets have changed compared with 2020 its possible the rate youll pay on short-term gains also changed. Since the 2021 tax brackets have changed compared with 2020 its possible the rate youll pay on short-term gains also changed. For single folks you can benefit from the zero percent capital gains rate if you have an income below 40000 in 2020.

Capital gains tax rates on most assets held for a year or. 250000 of capital gains on real estate if youre single. 2020 Tax Rates on Long Term Capital Gains.

2020 Tax Brackets Tax Foundation and IRS Topic Number 559 For Unmarried Individuals For Married Individuals Filing. Most single people will fall into the 15 capital gains rate which applies. The IRS typically allows you to exclude up to.

Those tax rates for. However which one of those capital gains rates 0 15 or 20 applies to you depends on your taxable income. Long-term capital gains tax is what you pay on assets that you sell after owning them for more than a year.

IRS Restores Capital Gains Tax and Other Tax Return Changes for 2020 Ready or not the tax return changed again during the 2020 tax season.

Capital Gains Tax Calculator For Relative Value Investing

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

How High Are Capital Gains Taxes In Your State Tax Foundation

How Do State And Local Individual Income Taxes Work Tax Policy Center

Can Capital Gains Push Me Into A Higher Tax Bracket

How Is Tax Liability Calculated Common Tax Questions Answered

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

How To Pay 0 Capital Gains Taxes With A Six Figure Income

A 95 Year History Of Maximum Capital Gains Tax Rates In 1 Chart The Motley Fool

What You Need To Know About Capital Gains Tax

How Do Taxes Affect Income Inequality Tax Policy Center

What S In Biden S Capital Gains Tax Plan Smartasset

Capital Gains Tax Calculator For Relative Value Investing

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)